BROADWALK SERVICES AWARDS 2019[+/-]

Twelfth year of recognising outstanding achievements in the services sectors

This is the twelfth year of the Broadwalk Services Awards to recognise outstanding achievements by quoted companies and their management teams in the broadly defined business services sectors. Competition was again fierce with a strong array of contenders – highlighted by the impressive short lists. The broadly defined services sectors are one of the less well known success stories of the global economy and are amongst the largest private sector employers. These unique awards are another step towards raising the companies’ and the sector’s profile. We congratulate all the companies and their management teams.

Charlie Cottam – founder, Broadwalk Asset Management LLP

Advisory Panel

The awards have had the significant benefit of views from:

- Jarrod Castle, BLT Sector Head, UBS Investment Research

- Vasco Litchfield, Managing Director, Lazard

- Jane Sparrow, Director Mid&Small Cap Support Services Research, Barclays

- Stuart Vincent, Managing Director, Rothschild

About Broadwalk Asset Management LLP

Broadwalk Asset Management LLP is a private investment management company based in London. It was founded in 2007 by Charlie Cottam and manages an absolute return strategy which focuses on investing in publicly quoted Services companies. This includes equities in the Support Services, Construction, Real Estate, IT, Transport and Healthcare sectors.

Important disclaimers are at the back of this document.

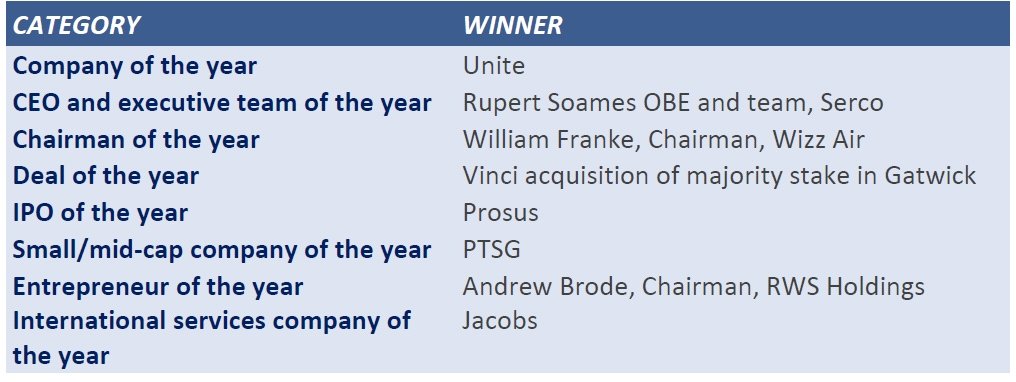

AWARDS

Company of the Year [top] - Unite Group

Unite Group’s acquisition of Liberty Living in November for £1.4bn has cemented its position as the largest operator of Purpose Build Student Accommodation in the UK. Liberty Living’s high quality portfolio comprising 24,000 beds across the UK was independently valued at £2.2bn in May 2019. The acquisition creates a portfolio with gross asset value of £7bn, with 75,000 beds in 27 UK towns and cities across the UK. The acquisition complements Unite’s existing portfolio, through a common focus on high quality, affordable student accommodation aligned to universities where student demand is strongest. This supports the company’s rental growth outlook of 3.0-3.5% for 2019/20 and 2020/21. The deal also leverages Unite’s best in class operating platform to deliver expected annual cost synergies of £15 million from 2021, helping to enhance Unite’s earnings yield. The Group posted strong results for the first half of the year. EPRA earnings grew 16% to £61m, compared to the same period in the previous year. EBIT margin jumped to 76.0% from 73.7%. A record 92% of beds were already booked for the academic year 2019/2020 before end of July. The Group delivered 2,390 new beds on time and on budget for the 2019/20 academic year and has a further committed development pipeline of 4,800 beds for delivery over the next three years.

SHORTLISTED

DSV Panalpina

In August 2019, DSV Panalpina became one of the world’s largest transport and logistics groups, following DSV’s CHF 5.4bn ($5.5bn) acquisition of supply chain solutions provider Panalpina. An expanded global network with vertical expertise, operational efficiencies and enhanced service offerings enables the Group to solidify its competitive position in the global transport industry. The combination employs a workforce of 60,000 in 90 countries and will generate pro forma annual revenues of DKK 118bn ($18bn), and expected annual cost synergies worth DKK 2.3bn ($340m) by 2021. Panalpina shareholders received 2.375 DSV shares for each Panalpina share, which was a 30% capital increase. This is CEO Jens Andersen’s largest purchase to date, following his strategy of acquisition led growth. The focus for the next 12-18 months is on the integration of Panalpina, before embarking on further industry consolidation. DSV’s latest results for the year to September showed organic growth in EBIT before special items of 7.9%, which is a strong result in the context of volatile markets given macroeconomic uncertainties and the trade tensions.

IWG

In April CEO Mark Dixon (Broadwalk Entrepreneur of the Year 2013), announced the intention to shift to a franchise partnership model for most of IWG’s global office operations. The first deal was the lucrative sale of the Japanese business in April 2019 for £320m to TPK Corporation. The sale included exclusive rights to use IWG’s Regus, Spaces and OpenOffice brands in the country. IWG is working closely with TKP to continue to develop attractive growth opportunities. TKP has committed to a development plan that will expand the network significantly in Japan. Under the new model, IWG will act as the master franchise, providing support services to the franchisee including access to its brand portfolio, global network, operational infrastructure and technology and sales and marketing resources in return for a recurring fee linked to revenue. The Japanese deal values the business at 15.5x 2018 ebitda of £20.6m. In November IWG agreed on the sale of its Swiss assets for £94m, to a joint entity owned by private banking group J. Safra Group and real estate investor P. Peress Group. IWG, with operations in over 110 countries globally, is in talks with a number of potential franchise partners. The franchise model could enable IWG to expand to 30,000 locations globally from its current c. 3500. IWG is confident of the structural long term growth opportunity in the flexible workspace market. Being a leader in the space, the Group is making significant progress with its asset light strategy as interest remains high from third parties for the partnership deals. By early November, IWG had 27 partners in 22 countries together committing over 400 new locations. Having bought UK meeting room provider Clubhouse in October, IWG is also open to using its strong financial position to take advantage of further acquisition opportunities.

Loomis

Loomis is a leading international cash handling specialist. Cash as a share of total transactions is declining, but in absolute terms the cash payment market continues to grow as a result of global population growth and increase in number of financial transactions per person. Projections show that the market could be 20% larger by 2023. The highly fragmented nature of the market provides consolidation opportunities for market leader Loomis. President and CEO, Patrik Andersson, has made two regional acquisitions this year. In January 2019, Loomis, through its German subsidiary announced the acquisition of Ziemann for an enterprise value of €160m. Ziemann, which primarily provides domestic cash handling services, generated revenues of €175m in 2018. In July 2019, Loomis through its subsidiary completed the acquisition of Prosegur Cash France, for an enterprise value of c. €39m. France has a large cash market and is important to Loomis. The company signed a unique agreement with fintech company WestPay in August 2019 to consolidate payments at retailers by adding card payments to cash handling operations. In the US about 60% of the cash management solutions are still handled by banks and the potential for additional outsourcing is significant. Market penetration of Loomis’s solution SafePoint is below 20%. Higher revenues from SafePoint and efficiency improvements have been driving earnings growth in the US. Loomis has undertaken restructuring programmes in different countries to further enhance efficiencies and to benefit from growth opportunities. As a result of the various initiatives, the Group is on target to achieve the 2021 financial targets, which includes revenues of SEK 24bn ($2.5bn) split 50:50 between acquisitions and organic, and operating margin of 12-14%. For the first nine months of the year, revenue grew 10% to SEK 16bn ($1.6bn), compared to the previous year. Organic growth was 3%. Operating margin (ebita) improved to 12.2% from 11.3%. Ebit amounted to SEK 1.8bn ($180m), having grown 12%.

Sopra Steria

In September, Sopra Steria, a European leader in digital transformation, launched Sopra Steria Next, one of the largest digital transformation consulting brands, with 3,400 experts in Europe. The launch is the fruition of the initiative led by CEO Vincent Paris since 2015 to consolidate and transform the Group’s consulting activities under a powerful new brand. Agility of digital technology plays a key role in organisational performance and Sopra Steria Next has the comprehensive business, sector and technology specific expertise and implementation capabilities to enable clients to achieve their innovative digital transformation goals. Sopra’s strategy is to raise value from offerings. The Group has been acquisitive and to turnaround the underperforming Banking Software division, Sopra acquired its peer, the French core banking solutions provider SAB in April. SAB generated €64m in revenue in 2018, of which 30% was recurring 12% was from ASP (Application Service Provider) services. Apart from enabling the division to return to historic operating profit margin levels from 2020 onwards, the deal enhances the division’s ability to provide core banking services in ASP mode, which is becoming more popular with the open banking initiative, for on-demand solutions without large capex requirements. To focus on its core offerings, in June, Sopra sold its UK recruitment subsidiary. Due to the Group’s consistent efforts, results to September 2019 indicate the Group is on track to achieve full year targets. Revenue rose 9.5% to €3.2bn, organic growth was 7.7%. In August, the Group had raised its full-year organic growth guidance for a second time during the year, and the current target is 6.3% to 6.5%. In July, the company had said it expected organic growth of 6% or higher in 2019 compared to 4% to 6% previously. The Group also targets operating margin from business activity to improve slightly from 7.5% in the previous year, and free cash flow above €150m.

CEO and executive team of the year [top]

Serco CEO Rupert Soames OBE and executive team

Serco CEO Rupert Soames OBE

In May 2014 CEO Rupert Soames OBE was brought in to turnaround Serco which was facing significant challenges. He also brought his Finance Director from Aggreko, Angus Cockburn. During the five years with charismatic Soames at the helm, the Group has transformed into a more agile and disciplined international specialist supplier of support services. After several years of decline, the group is now focusing on winning work at more acceptable margins, and group-wide profitability is showing encouraging signs of recovery. 2018 marked an inflexion point for Serco when the Group posted a solid performance, focusing on its core areas of health, defence, transport, justice and immigration, and citizen services. Shedding unprofitable contracts, Soames drove underlying trading profit at constant currency up 40%. Revenues stabilised, and profit growth was a result of strong operating performance and cost efficiencies from the transformation efforts. Serco closed the 2018 year with a strong balance sheet and has started making acquisitions again, acquiring in 2019 the Naval Systems Business Unit (NBSU) of US defence technology group Alion for $225m. In another major win, Serco secured an £800m contract from the Ministry of Justice to provide prison escort and custody services across the South of England. With a strong order intake, management is confident of making further progress with strong revenue and profit growth expected for this year and next, and remains focused on disciplined bidding.

SHORTLISTED

Arcadis - CEO Peter Oosterveer and executive team

On his appointment as CEO in April 2017, Peter Oosterveer conducted a strategic review of the business. His plan was to capitalise on megatrends such as urbanisation and mobility, sustainability and climate change, globalisation and digitisation. CEO Oosterveer and his team decided to invest rapidly to become a digital frontrunner in the industry. Project selection discipline was improved and client relationships leveraged to create organic growth. The Middle East and Asia were de-prioritised. Financial targets included organic growth exceeding GDP growth in end markets, and operating margin of 8.5% to 9.5% in 2020, an improvement of over 2.4% from the 2016 figure of 7.1%. CEO Oosterveer made several bolt on acquisitions. These deals enabled Arcadis to enhance technological capabilities in tools such as BIM, drones, sensors and mobile apps, and to capture market share. The optimisation of North American operations in 2017 was a key reason for the Group’s strong performance in 2018 with operating ebita margin already touching the 2020 target range, similar to the achievements in Europe, Australia, and the UK. The Group’s shift towards digitisation has been rewarded with significant contract wins including a partnership with Transport for London and the agreement with water solution provider Evocra to use its patented processes. For the nine months of 2019, organic net revenue for the Group increased 2% to €1.9bn, and operating ebita margin improved to 7.8% from 7.3%.

Computacentre- CEO Mike Norris and executive team

CEO Mike Norris has had a 35 year career at Computacentre, 25 years as its CEO. He led the company through its IPO in 1998 and has grown it into a $2.4bn business with capabilities to compete in large deals with the likes of Accenture and Tata Consultancy Services. With a significant footprint in Europe, Computacentre is the largest reseller in the continent. CEO Norris believes the channel is in the middle of a super cycle of growth. In October 2018 the company grew its US market presence with the acquisition of FusionStorm for $90m. The deal enables it to offer the full range of services in the US as in Europe. Computacentre’s focus in the US is specifically on enterprise clients, especially those with a European presence. In August, CEO Norris was able to buy back Arrow’s IT Asset Disposition (ITAD) in just three weeks, after Arrow announced that it was shutting the unit down, having bought it from Computacentre for £56m in 2015. CEO Norris moved quickly as it was important to retain the staff, customers and contracts in order to protect Computacentre’s corporate clients. For the first half of the year, despite UK revenue falling by 8% amid political uncertainty, Group revenues grew 21% to £2.4bn and adjusted profit before tax grew 2.7% to £54m. This included benefits from acquisitions made since June 2018. This is without fresh acquisitions, but with more significant contribution from the acquisition of FusionStorm. Also, on a like for like basis, revenue and profitability remains well ahead for the year to September, compared to the previous year. For the full year 2019, the Group expects profit growth in monetary terms to be the best in company history.

Ferguson- CEO John Martin and executive team

John Martin was appointed CFO in 2010 and was made CEO in 2016. In September 2019 CEO Martin announced he was standing down in favour of Kevin Murphy who runs Ferguson Enterprises in the US, and that the UK operation was to be spun off. The demerger will enable the two companies, Wolseley UK and Ferguson North America, to wholly focus on their respective markets. Each business will be able to concentrate on accelerating its independent investment and growth strategy, and Ferguson Enterprises will continue to build on a strong track record of market outperformance and profitable growth. CEO Martin has brought strategic clarity to the business, exiting lower growth markets, establishing market leading positions in attractive markets and ensuring solid financial performance. During his tenure, the Group witnessed 37 consecutive quarters of revenue growth and 9 consecutive years of operating profit growth. For the fiscal year ended July 2019, revenues rose 7.9% in constant currency to $22bn and operating profit grew 7.5% to $1.6bn. During his tenure from 2010, share price rose an impressive 3.8 times to 6,722p.

Chairman of the year [top]

William Franke, Chairman, Wizz Air

Bill Franke, airline entrepreneur and pioneer of ultra-low cost air travel, founded Hungary based Wizz Air in 2004. With a relentless focus on costs, it has grown to become one of Europe’s strongest and most efficient airlines and the largest low cost carrier in Central and Eastern Europe. Co-Founder József Váradi has been CEO of the company since its inception. Mr Franke as co-founder and managing partner of Indigo Partners is also the largest shareholder of Wizz Air with a 21% shareholding. In June Mr Franke signed an MoU with Airbus, valued c. $4.5bn, to buy 50 new A321XLR commercial jets, out of which the highest number 20 are allocated to Wizz Air. Mr Franke was able to obtain attractive pricing by placing one of the largest orders for the extended version of Airbus’s top selling aircraft through Indigo Partners. The aircrafts, to be delivered from 2023 onwards, enable Wizz to further expand its network and will give a strategic advantage to the airline due to intrinsic economics of the model. Mr Franke is also credited with placing a 427 A320 and A321 neo order with Airbus for c. $50bn in December 2017, out of which 146 aircrafts were allotted to Wizz. These customer friendly and efficient aircrafts which are expected to deliver 20% fuel savings by 2020 create more value for the airline as well as passengers. While some rivals are venturing into low cost long haul operations, Mr Franke believes it is a potentially expensive risk to take, as the industry is still waiting for the right kind of highly efficient aircraft. Having established cost leadership, superior customer services and a young best in class fleet, he is optimistic of Wizz Air’s future growth prospects and ability to perform under all market conditions. Mr Franke was CEO and Chairman of America West Airlines between 1993 and 2001. Through Indigo Partners, Mr Franke also holds majority stakes in three other low cost airlines, namely, Frontier Airlines (USA), JetSMART (Chile), Volaris (Mexico).

SHORTLISTED

Ryanair- Chairman David Bonderman

Mr. Bonderman was appointed Ryanair Chairman in 1996 and has provided invaluable support to CEO Michael O’Leary in growing the airline into an undisputed leader among low cost carriers. An astute businessman and airline veteran, Mr Bonderman has identified a number of seemingly unworthy opportunities which turn out to be excellent investments and he has participated in many large deals. His company 1996 Air GP had made a $42m initial investment in Ryanair in 1996 for what turned out to be a very valuable 20% stake after Ryanair floated in the stock market in May 1997. Air GP has subsequently reduced the shareholding to hold a minority stake currently and has made a substantial profit in the process. Over the years, Ryanair’s “yield passive, load factor active strategy” of reducing fares to whatever levels required to fill planes, has paid off and enabled Ryanair to capture significant market share. Mr Bonderman prefers to stick to the tried and tested Ryanair strategy focusing on short haul routes which helps the airline reap the maximum benefits. As a result he insists that Ryanair will not fly trans-Altantic routes, as it is a different business model altogether. The share price has raised more than 15x to €13.99 over Mr Bonderman’s chairmanship and Ryanair now has a market capitalisation of €15bn. He has had a highly successful career as founder of the TPG Private Equity Group, which has $84bn of assets under management.

Sodexo - Chairperson Sophie Bellon

Ms Bellon took over as Chairperson from her father Pierre Bellon, founder and Chairman Emeritus, in 2016. She has been closely involved with Group operations for the past 25 years in various capacities, and has played a pivotal role in growing and positioning the Group as a €22bn global leader in quality of life services with operations in 80 countries. Ms Bellon joined Sodexo in 1994, at a time when the Group was evaluating several major acquisitions. She took active part in the acquisition of Gardner Merchant in the UK which doubled the size of the Group and three years later, was instrumental in the acquisition of Marriott Management Services in the USA, which again doubled the size of the business and helped Sodexo strengthen its position as a multinational company. With her long term perspective, Ms Bellon has left an indelible mark in various facets of Group operations including defining operational controls and performance indicators which are still in force, instilling a strong client oriented culture with very high client retention rates and continuing with innovation led profitable growth. As Chairperson, she has formed a strong working relationship with CEO Denis Machuel, who was promoted in January 2018, and has enabled him to pursue Sodexo’s strategy of profitable growth. This year, she has refreshed the board to include Véronique Laury, ex-CEO of Kingfisher and Luc Messier, who has held managerial positions at ConocoPhilips, Technip and Bouygues. In addition, she had initiated a share buyback programme amounting to €300m during fiscal year 2017-2018.

Softcat- Chairman Martin Hellawell

Mr Hellawell was CEO of Softcat for twelve years before becoming Chairman in April 2018. He grew Softcat from a £57m company that made a net profit of £819k in 2005, to a leading value added reseller (VAR) in UK which crossed the £1bn revenue mark and made £55m in net profit in 2018. Meanwhile, in November 2015, Mr Hellawell hit another milestone when he led Softcat’s transition from one of UK’s fastest growing private VAR to a publicly listed company through a highly successful IPO which valued Softcat at £472m. Over the years, Softcat has followed the simple strategy of extending market share through acquisition of new customers as well as selling more to existing customers. And Mr Hellawell executed this strategy through expansion of the salesforce and focus on customer service. His successor CEO Graeme Watt has not changed this proven Softcat strategy; instead he has extended it and focused on execution. Under Mr Hellawell’s guidance, CEO Watt’s next step is to expand the addressable market as customer needs are becoming more complex and they are presented with more choices. To utilise this opportunity, Softcat is investing in expertise for the long term. Recent trend is towards customers’ reliance on a few large partners and Softcat is well positioned to benefit, given its wide range of technology and services developed over the years. In the four years since IPO, Softcat’s share price has risen nearly 5x from the offer price of 240p to 1,126p. Mr Hellawell is also Chairman of Raspberry Pi, a commercial subsidiary of the philanthropic Raspberry Pi Foundation which promotes computer science education in schools. Prior to Softcat, he was with Computacentre for thirteen years where he was part of the IPO team and built an excellent track record in senior management roles.

Deal of the Year [top]

Vinci acquisition of majority stake in Gatwick airport for £2.9bn, announced in Dec 2018

Vinci, the global player in construction and transport concessions, has acquired a majority stake in Gatwick, a freehold airport. The £2.9bn deal for a 50.01% stake was completed in May. The French group took advantage of depressed asset prices and lower sterling in the wake of Brexit uncertainty. Nicolas Notebaert, CEO of Vinci Concessions, led the deal under the guidance of Chairman and CEO of Vinci group, Xavier Huillard. CEO Notebaert believes that Brexit would not change Gatwick’s bright prospects, given capacity constraints of London airports, long list of airlines in queue for slots and strong demand from tourists for travel to London. Through the period from December 2009 to 2019, Gatwick has grown passenger numbers by more than 40% from 32m to 46m, while maintaining high passenger satisfaction scores. Vinci already operates 45 airports in 12 countries across Europe, Americas and Asia. With the addition of Gatwick, Vinci has become the second largest airport operator in the world, after Spain’s Aena. Gatwick has given Vinci access to the world’s largest metropolitan aviation market. Bringing its international expertise, Vinci aims to focus on quality of service and airport management. Gatwick, as the most efficient single runway airport globally, will share its best practises with Vinci to enhance its operational improvement strategy. Gatwick has plans to expand its two terminals in five years and to use its existing second runway by mid 2020s to increase slot numbers. The California Public Employees’ Retirement System (CalPERS), as part of remaining 49.99% interest managed by Global Infrastructure Partners (GIP), will retain a 9.99% stake in Gatwick. The sale values Gatwick at a reasonable 19 times ebitda. The transaction

SHORTLISTED

BCA Marketplace acquisition by TDR Capital for £1.9bn, announced in June 2019

British used car auctioneer and reseller, BCA Marketplace, agreed to a cash takeover by private equity group TDR Capital for £1.9bn. BCA is a European market leader in automotive aftermarket services, including purchase and remarketing of vehicles and related value added services. The offer price of 243 pence per share represents a premium of c.25% to BCA’s closing price for the month ended 19 June, the last day prior to commencement of offer period. This implies an enterprise value multiple of 12.5x adjusted ebitda of c. £172m for the year ended March 2019. The offer comes a year after BCA rejected an offer of £1.6bn, which valued the Group at £200 pence per share, from private equity group Apax Partners. BCA floated on the LSE Main Market in April 2015 at an issue price of 150p. The bid price offers a 62% upside to this issue price. TDR has a strong track record of investing in businesses and enabling the management to grow their operations. The deal will allow BCA, the owner of WeBuyAnyCar.com, to continue to develop and grow its automotive services market offerings in a rapidly evolving market driven by digital disruption and changing customer expectations. For the fiscal year ended March, BCA had delivered a resilient performance in a subdued market selling more than a million vehicles and growing revenues by 25% to £3bn and operating profits by 14% to £100m. Improved profitability resulted in adjusted ebitda growing by 9% to £172m.

RPC acquisition by Berry Global for £3.3bn, announced in March 2019

(Broadwalk CEO and Executive Team of the Year, 2015), accepted a takeover offer from US headquartered Berry Global Group, a world leading provider of plastic packaging and protective solutions, for £3.3bn. Berry outbid Apollo Global, and offered to pay c. $4.3bn in cash for the equity interest and assume $2.2bn of net debt of RPC. The deal, completed in July, created one of the world’s largest plastic packaging companies. The combined business now employs c. 50,000 people in 290 locations spread across six continents and generates c. $13 billion in revenue. Berry aims to leverage the combined power of product development and manufacturing technologies RPC had to offer. The enlarged group is now capable of offering innovative and low-cost solutions to thousands of multinational and local customers globally through the industry’s most diversified and extensive manufacturing footprint. The deal is anticipated to be earnings and cash flow accretive with c. $150m of expected annual synergies.

Sophos acquisition by Thoma Bravo for £3.1bn, announced in October 2019

In October Sophos agreed to be acquired by American private equity firm Thoma Bravo for £3.1bn ($3.9bn) at a price of £5.83 per share in cash. It represents a 37% premium on the previous week’s closing price. The valuation was an impressive 5.2x sales. The deal is one of the largest private takeovers in the UK technology space in recent years. Sophos (Broadwalk Company of the Year, 2017) is a global leader in next-generation endpoint and network security solutions, protecting more than 100 million users within 400,000 customers worldwide. CEO Kris Hagerman led the company’s float in 2015 at 225p, the largest ever IPO of a software company in UK, valuing Sophos at £1bn. In the same year, Sophos launched Synchronised Security with the Security Heartbeat, a first in the industry, which enables network and endpoint products to communicate and share intelligence to improve protection. In February 2017, it acquired Invincea for $100m to strengthen its next-generation products with learning and behavioural monitoring to enhance malware threat detection and prevention using AI. A key element of Sophos’s business strategy is the cross-sell and up-sell of its comprehensive portfolio with existing customers, which it reaches through more than 47,000 channel partners worldwide. Sophos has been driving the successful adoption of next-gen cloud endpoint. In the first quarter of the year, next-gen represented 55% of total billings, up from 39% in the previous year, growing at 43% in constancy currency. Since IPO, Sophos has continued to outgrow the IT security market with compound annual growth rate of 12% in billings and revenue. Thoma Bravo already has investments in cyber security companies Imperva and close peer Barracuda, and should be able to derive additional synergies. Sophos will remain a standalone company.

IPO of the year [top] - Prosus

Prosus, the spin-off from South Africa based global internet group Naspers, made its debut in Euronext Amsterdam in September, to become the second largest listed technology company in Europe. The issue price was €58.70 per share, implying a market value of €95bn. Goldman Sachs, JP Morgan and Morgan Stanley were the lead financial advisers. Banca IMI, Bank of America Merrill Lynch, Barclays, BNP Paribas, Citigroup, Deutsche Bank, ICBC Standard Bank and ING were financial advisers.

Prosus Group, the largest technology investor in the world, is the holding company for Naspers’ global consumer internet businesses including social networking, classifieds, payment solutions and fintech, food delivery, e-retail and online travel booking with market leadership in 77 markets. Prosus holds a 31% stake in Tencent, the Chinese tech giant. The stake, now worth c. $130bn, originated from what is considered as one of the most profitable investments in corporate history, a $34m investment by Naspers Chairman, Koos Bekker, in 2001 when Tencent was a start-up. This propelled Naspers’ rapid growth to become Africa’s most valuable listed company. For years, the Tencent stake was worth more than Naspers itself and one reason for the Prosus spin-off is to narrow this value gap. The Prosus listing will move about a quarter of Naspers’ value to the Amsterdam exchange and thereby reduce its heavy weighting in the Johannesburg exchange. Prosus comprises all internet interests outside South Africa, previously held by Naspers. It owns stakes in more than 40 companies including global online marketplace OLX, payment technology company PayU, German food delivery group Delivery Hero, Indian online food delivery service Swiggy, Indian online travel site MakeMyTrip, Russia’s biggest online classifieds and property platform Avito and the biggest Russian internet company mail.ru. This is a unique portfolio of internet businesses, and enables CEO Bob van Dijk to pursue future growth plans. In the past year, Naspers made investments worth c. $3bn globally in various ventures. In October the Group made a cash bid of £4.9bn for UK’s Just Eat, and increased it to c. 5.1bn in December. Further investments are also expected in classifieds, machine learning and online education. No new shares were issued for the listing. Only existing shareholders could convert part of their shares into the new Prosus shares. Naspers retains a 73% stake in Prosus.

SHORTLISTED

DWF

With its March 2019 IPO at a market capitalisation of £366m, DWF became the largest listed law firm globally and the first and only law firm to float in the main market of LSE. The IPO was priced at 122p per share. The firm raised £95m. Stifel and Jefferies International were the joint global coordinators and Zeus Capital the lead manager.

DWF provides a range of legal professional, business and consulting services through its Commercial Services, Insurance and International divisions. For the full year to April 2019, DWF generated gross profit of £146m, which increased 16% year over year. Revenues grew 15% to £272m. Out of the IPO proceeds, £19m repaid a portion of members’ capital and £10m was to be invested in additional IT systems, with the reminder for working capital and targeted acquisitions. The IPO will enable DWF to capitalise on the positive trends in the global industry and to continue to offer differentiated services and to expand to international markets. Managing Partner and CEO Andrew Leaitherland plans to build on the strong track record and to further grow the firm’s complex managed and connected service capabilities. The Group continues to deliver on its strategy and for the half year, revenues grew at not less than 10%, majority of it being organic. The pipeline of work for the second half is strong, aided by further partner hires in International and activation of the BT Managed Services contract. The shares floated represent 26% of the firm’s issued share capital. Resultant upon the IPO, former equity partners will face a 60% reduction in their current profit share and non-equity partners will see a reduction of 10%. Partners will be locked in for five years with shares released in tranches of 10% per year after publication of financial results in 2020. Depending on performance, a further 10% will be released.

Network International

Network International raised £1.1bn in its April 2019 IPO in the London Stock Exchange. The Dubai based company priced the offering at 435p per share; a market capitalisation of £2.2bn. Citigroup was the sole sponsor and joint global coordinator. Emirates NBD Capital, JP Morgan and Morgan Stanley were joint global coordinators. Barclays and Goldman Sachs were joint bookrunners. Liberum was co-lead manager and Evercore Partners the financial adviser.

Network International is a leading payments solutions provider in the Middle East and Africa, with a partner network of 220 financial institutions and 65,000 merchants across more than 50 countries. The company was created as a subsidiary of Emirates Bank, Dubai largest bank, in 1994. Network owns the distinction of being the first independent vendor to be certified by both Visa and MasterCard for payments in the Middle East. Under the leadership of CEO Simon Halsam, Network has continued to invest in strategic partnerships to grow the geographic footprint. This enabled the company to grow revenues at 13% per annum over the past three years to $298m in 2018 at a relatively stable ebitda margin of 50%. Middle East constitutes 75% of sales and Africa 25%. For the half year to June, revenues grew 12% to $152m, with underlying ebitda margin of 50.1%. Network is the leading enabler of digital commerce across the most underpenetrated markets globally. Cash is still dominant in these regions at around 75% of payments. Shareholders Emirates NBD PJSC, Warburg Pincus and General Atlantic reduced their holdings through the IPO. Post-IPO, Emirates owns 25.5% of shares and Warburg and General Atlantic own 24.5%. Shares offered also include the investment of $300m by MasterCard in return for a 10% stake.

Nexi

The Milan IPO of digital payment services company Nexi raised €2bn. Shares were offered at €9 each giving the company a valuation of €7.3bn including debt, or 17.2 times core earnings. The offer was a combination of existing and new shares and resulted in a capital increase of €700m. Market capitalisation at debut was €5.7bn. BofA Merrill Lynch, Banca IMI, Credit Suisse, Goldman Sachs and Mediobanca acted as joint global coordinators. Bank of America Merrill Lynch, Banca IMI, Credit Suisse, Goldman Sachs and Mediobanca were joint global coordinators and joint book runners along with Banca Akros, Barclays Bank PLC, Citigroup Global Markets, HSBC, MPS Capital Services, UBI Banca, UBS and UniCredit.

Based in JersAs the largest payment technology company in Italy, Nexi partners with around 150 banks covering 80% of the domestic banking sector. Nexi and partner banks serve around 890,000 merchants and manage 1.4m POS terminals. The company has a 60% market share in card issuing and manages 41m cards with banks. Nexi manages 13,400 ATMs and over 900m transactions in clearing services. The company is also developing open banking in collaboration with Interbank Corporate Banking (CBI) consortium. Nexi is profitable and generated operating pro-forma revenue of €931m and normalized ebitda of €424m in 2018. For the year to September, revenues grew 5.6% to €718m and underlying ebitda grew 19% to €369m. The proceeds of the IPO, combined with €1.35bn in fresh financing from a group of banks involved in the IPO, were primarily used to reduce and refinance debt to a projected €1.8bn gross. Nexi expects its net financial position to be at c. 3.0x by end 2019. In Italy, only 24% of purchases are cashless compared with more than 50% in the Netherlands. Nexi is well positioned to take advantage of the relatively underpenetrated market. The financial guidance is for annual revenue growth at 5%-7% and ebitda growth of 13%-16% in the medium term, with 2019 ebitda growing at 18% to c. €500m. Nexi is headed by CEO Paolo Bertoluzzo and investors include private equity firms Advent International, Bain Capital and Clessidra, who bought Nexi from a group of Italian banks. Following IPO, their combined shareholding reduced from 94% to 60%.

TeamViewer

TeamViewer, a leading global connectivity platform, floated on the Frankfurt Stock Exchange in September at an offer price of €26.25 per share and value of €5.25bn, raising €2.2bn. Goldman Sachs and Morgan Stanley acted as joint global coordinators and joint bookrunners. BofA Merrill Lynch and Barclays were joint bookrunners. RBC Capital Markets was co-lead manager. Lilja & Co. was independent adviser.

TeamViewer was founded in 2005, in Goppingen, Germany, as a local provider of tools enabling remote computer access. It has grown to offer services in 180 countries. Remote desktop access and online meeting modules constitute the core offering. The tool has been installed on 2bn devices globally. A free version of the software is available to private users whereas enterprise customers pay a subscription fee. The subscription based model helps boost revenues and the company is already profitable. The aim of the IPO was to gain more visibility globally. The company’s addressable market of €10bn is projected to grow to €30bn in 2023 as companies invest in digital control, and as the number of employees working from home increases. TeamViewer was owned by private equity firm Permira, which acquired it in 2014 for €870m. Permira sold a 42% stake to generate €2.2bn. It retains 58% and will remain a strategic investor. CEO Oliver Steil came from Permira two years ago. TeamViewer’s focus in the short term is to build its presence in Asia Pacific and United States. It also plans to expand its marketing team for the enterprise version of the product. Selective acquisitions will complement organic growth. Billings grew an impressive 45% to €224m in the first nine months of the year, compared to the same period in the previous year. Cash ebitda grew 54% to €120m, resulting in a 3% increase in margin to 53%.

Trainline

Trainline, Europe’s leading independent train and coach ticket retailer, raised £110m in its June IPO in the London Stock Exchange. The offering was priced at 350 pence per share at a market capitalisation of £1.7bn. JP Morgan and Morgan Stanley acted as joint sponsors, joint global co-ordinators and joint bookrunners, KKR Capital Markets was joint global co-ordinator and joint bookrunner, and Barclays Bank and Numis Securities were joint bookrunners.

Trainline was founded in 1999 by a consortium of UK train companies and sold to private equity Exponent for £163m in 2006. An IPO was planned in 2015, but KKR bought the company for an estimated £450m. Under KKR, Trainline has pursued a high growth trajectory to become a one-stop shop for train and coach travel by integrating on its platform millions of routes, trips and fares from 260 rail and coach companies across 45 countries in Europe. Trainline acquired the French online ticketing platform Captain Train in 2016, to combine two of Europe’s leading digital ticket retailers and significantly expanded its geographic footprint. The company also developed its Single Global Platform, enabling it to improve from one release every six weeks to over 300 per week to provide real time insights to customers. Trainline’s intuitive AI driven mobile app is an essential travel companion for many frequent rail users. With an increasing global reach, the Trainline booking system receives 80m visits per month, 80% of which is from repeat customers. CEO Clare Gilmartin, who joined in 2014, has led Trainline’s transformation. Revenue has grown at a CAGR of 18% during FY 2016 to FY 2019, driven by 20% CAGR in net ticket sales. For the half year to August 2019, net ticket sales grew 19% to £1.8bn to generate revenues of £129m which grew 29%. Adjusted ebitda grew 99% to £42m. Trainline aims to use the net proceeds from the IPO to accelerate expansion plans, to benefit from the ongoing digitisation of rail and coach ticket booking across Europe and also internationally. Rail travel is expected to increase as reducing carbon footprint becomes a priority. KKR reduced its stake from 79% to 25% after selling shares worth £829m. Through two further placings in September and November KKR no longer has a stake in the company.

Small & mid-cap company of the year [top] - PTSG

Premier Technical Services Group (PTSG) is UK’s leading provider of niche specialist safety testing and compliance services through its four divisions of Access and Safety, Electrical Services, Building Access Specialists and Fire Solutions. PTSG offers services to more than 20,000 customers and 180,000 buildings across UK from its 29 sites, and benefits from substantial recurring revenues and high margins. With an industry leading renewal rate of 88% in year 2018, the Group generated more than 50% of its revenue from recurring maintenance and compliance services.

In July PTSG agreed to be acquired by Macquarie for £265m, all cash, at a huge premium of 142% to the closing share price prior to the announcement of the deal. The offer represents a very significant 304% premium to the IPO price of 52 pence per share in February 2015. The deal will enable co-founder and CEO Paul Teasdale to accelerate the selective M&A strategy to complement organic growth, which reached 19% in year 2018. From fiscal year 2015 to 2018, PTSG has grown revenues at an average annual rate of 39% to £69m and adjusted ebitda at 40% to £17m. End markets are becoming increasingly competitive, hence funding and quick closure are important. Macquarie’s backing will provide PTSG with enough firepower and flexibility to pursue a significant pipeline of opportunities it has carefully identified. PTSG has built a strong track record of successful acquisitions and has bought 15 businesses since IPO to attain market dominance. A majority of these acquisitions have been in Electrical Services which has enabled the division to become the largest contributor to Group revenues. PTSG’s goal has been to achieve the same in Fire Solutions by capitalising on high demand for services in this area. The Group also plans to achieve balance in the portfolio by further expanding services and regional presence in the other two divisions of Access and Safety and Building Access. In the meantime, the Group is also working towards ensuring that its infrastructure is capable of scaling to absorb significant additions. PTSG is constantly looking for ways to innovate in technology and software as well as organisational processes, and to improve efficiencies.

SHORTLISTED

Aptitude Software

Aptitude Software was founded in 1974 and is a leading provider of financial management and planning applications for CFOs. The company has offices in London, Boston and Singapore, and has a global reach. Aptitude has been successfully implementing its strategy of growing the recurring revenue base and focusing on higher growth segments.

In the year to June 2019, annual recurring revenues increased 29% to £28m, with the core offering Aptitude Accounting Hub (AAH) being the largest contributor to recurring revenue. The group also made a strategic move in June by divesting Microgen Financial Systems for a cash consideration of £51m, freeing up management time to focus on driving higher growth segments. Market fundamentals remain supportive as Aptitude’s target market of large global businesses has increasingly been automating financial operations, often being driven by increasing regulatory requirements. Aptitude’s global partner network includes KPMG, Deloitte, Accenture and Ernst & Young, and the company is engaged in an ongoing transition to a SaaS delivery model. This should enable Aptitude to capitalise on cloud deployment, where its North American clients are already focused, and open up cross selling opportunities in Europe and Asia.

Charles Taylor

Charles Taylor was founded c. 1840 in the north-east of England and has evolved over the years to become a leading international provider of professional services to clients in the global insurance market. The company was taken private for £261m ($325m) in September 2019 by LMP Bidco.

Charles Taylor is led by CEO David Marock, who joined in July 2011, and has overseen a significant increase in the share price. Mr Marock’s strategy was to make large, long term investments to secure the long-term success of the company, even if this was at the expense of near-term profits. Realising clients’ need for insurance solutions to solve problems, the company built up a range of technological solutions to transfer large amounts of data efficiently and effectively in a highly networked market. This enabled Charles Taylor to be successful in winning significant contracts, including a five-year transformative contract with leading Latin American insurer Seguros. LMP Bidco’s bid of 315p per share in cash represented a 34% premium to the share price prior to announcement of the deal.

Enter Air

Polish based Enter Air is one of the largest charter airlines in Europe. CEO Grzegorz Polaniecki has been at the helm since its formation, and the airline has grown consistently since its first commercial flight in 2010. The airline is the market leader in Poland with a 34% share, carrying 1.5m travellers. The international segment, where Enter Air carries 0.5m travellers is becoming increasingly important for the group, representing 40% of sales at higher margin.

Enter Air’s efficient low-cost business model has enabled the airline to remain profitable even under challenging market conditions. During the past two years, several competitors have exited the market while Enter Air emerged to the forefront. Tour operators have been supportive, with c.90% of Polish tours using air transport, and in the past decade, the number of tours conducted by Polish travel agencies has grown at c. 10% annually. The group has also entered/extended several strategic deals; in October 2019, Enter Air extended its co-operation agreement with TUI Poland for another two years. The co-operation began ten years ago with 8 routes and currently they together offer 120 connections for Polish tourists. In May 2019, Enter Air became a strategic partner and shareholder of Swiss airline Chair Airlines, with a 49% stake.

Murgitroyd

Murgitroyd is an international patent law firm and was founded by the current chairman Ian Murgitroyd in 1975 in Glasgow. Murgitroyd specialises in patents, trademarks, designs and copyrights, and provides clients with a broad range of services from case filing to litigation support and oppositions. The company was acquired by private equity firm Sovereign Capital Partners in October 2019 for 675p per share cash, valuing the business at c. £61m.

Murgitroyd has 18 offices in 10 countries including UK, Finland, France, Germany, Ireland, Italy and Switzerland. The firm also has direct representation rights in Austria, Belgium, Denmark, Luxembourg, Monaco, Netherlands, Norway and Sweden, as well as two client liaison offices in the US, and an office in Nicaragua which handles patent searching. Half of its revenue originates from the US. Over the years, Chairman Murgitroyd succeeded in transforming the company into one of the most highly rated patent law firms across different sectors. In the fiscal year ended May 2019, revenues increased 7.5% to £48m and profit before tax rose 16% to £4.2m, allowing for an increased final dividend.

Entrepreneur of the year [top]

Andrew Brode - Chairman, RWS Holdings

In 1995 Mr Brode acquired RWS, a professional translations business from the founding family with minority equity from 3i. He held a 75% shareholding and in 2003 listed RWS on AIM and currently owns a 32.8% stake. Under Mr Brode’s guidance, RWS grew to become a global leader in intellectual property support services and localisation and a major player in life sciences. Mr Brode promoted CFO Richard Thompson to CEO in April 2017. In November 2017 Mr Brode led RWS’s largest acquisition of Czech based Moravia for $320m, a leading provider of technology enabled localisation services, with operations in USA, Japan, China, Argentina, Hungary and Ireland and a client base that included the large US technology firms. The Moravia acquisition, contributed 25% of 2018 profits as its margins rose from 9.3% to 19.3%. For the year ended September 2019, RWS Moravia contributed 42% to Group revenues having generated record sales of £150m with growth of 18% over the previous year. The division posted adjusted operating profit of £26m with record growth of 52%, contributing 33% to Group profits. The Group as a whole also saw record performances across all three main divisions. Revenues grew 16% to £356m and adjusted operating profit grew 18% to £78m. Net debt fell by 43% to £37m and net debt to ebitda stood at less than 0.5x at year end, underscoring the cash generative business model. RWS continues to focus on international expansion and profitable growth by combining organic growth, selective acquisitions and cross selling opportunities from enhanced service offerings. The share price on a total return basis is up 2800% since the 2003 float, given a stunning annualised return over 16 years of 23.4%. Mr Brode is also Chairman of £760m market cap Learning Technologies Group.

RWS Holdings Chairman Andrew Brode (left) with Charlie Cottam

International Services Company of the year [top]

Jacobs

California headquartered Jacobs provides end to end professional services including technical, scientific, project delivery and consulting to industrial, commercial and government clients. Since August 2015, Chairman and CEO Steven Demetriou has led the Group’s transformation and growth, from an engineering and construction services provider into a higher value, higher growth, solutions oriented company.

To steer the portfolio towards highest margin growth businesses, and reduce cyclicality, Jacobs completed the sale of its Energy, Chemicals and Resources business for $3.3bn in April. Further, to position itself as a leader in high value and mission critical government services, the Group completed the acquisition of KeyW, a leading national security provider of advanced engineering and technology solutions for intelligence, surveillance and cyber operations, in a $903m transaction in June. Significant synergies have already materialised in the first quarter of fiscal year 2020, as Jacobs has won a five year $216m specialised cybersecurity training contract from the Department of Defence which leverages its combined capabilities with KeyW. In August Jacobs announced the $300m acquisition of UK based Wood Group’s nuclear services, which will further strengthen the Group’s positioning in highly profitable and complementary sectors in nuclear and defence. The transformation efforts concluded in November with the global launch of the new brand and proposed name change to Jacobs Solutions to reflect the new image. The transformed portfolio is well positioned to capitalise on secular growth trends such as environmental resilience and sustainability, IT-OT convergence and national security. In October Jacobs won a landmark project to deliver renewal energy solutions to support the planned SuedLink programme, a key component of Germany’s power grid upgrade to meet its renewal energy goals. To support its growth strategy in Europe and Middle East, the Group, in November, opened a European flagship office in London, to provide advanced digital and other solutions to enable successful delivery of various projects related to clean energy, cyber defences and connected communities, among others. Results for the full year to September showed strong net revenue growth of 22% to $10bn year on year. Adjusted ebitda grew 22% to $981m and adjusted operating profit grew 25% to $893m. Backlog grew 13% to $23bn and book to bill ratio was 1.1x. The full year 2020 guidance indicated further double digit growth.

SHORTLISTED

CSG Systems

CSG Systems, led by President & CEO Bret Griess, provides business support solutions to communications service providers (CSPs). This includes customer account activation and fulfilment services. The company has achieved growth by displacing a major competitor to provide services to Altice, a large US based broadband/video service provider. CSG also did a deal with Charter Communications and enabled world's largest movie theatre chain, AMC Theatres, to provide an on-demand streaming service.

CSG (Cable Services Group) was founded as a division of payment processing company First Data Corp which was at that time operated by American Express. Growth initiatives include increasing R&D and go-to-market investments, as well as making acquisitions to expand solutions and build scale. The group also aims to further collaborate with partners to extend capabilities and footprint. Examples of strategic moves include the October 2018 acquisition of Texas based payment solutions provider Forte Payment Systems for $85m. This expanded CSG’s payment and monetisation capabilities by enhancing its public cloud offerings and presence in new verticals. Figures have been encouraging, with CSG posting strong results for the first nine months of the year with adjusted revenues increasing 10% to $691m and adjusted operating profit growing 17% to $124m, year on year.

Service Stream

Service Stream is a provider of services to Australian utility companies. This includes services to develop and operate utilities such as telecommunications, energy and water networks. Mobile network operators have been increasingly outsourcing management of sites & towers and the company has also been successful in gradually broadening its service offerings to include the utilities sectors of energy and water.

Under Managing Director Leigh Mackender, Service Stream has positioned itself well to take advantage of both organic and acquisition led growth opportunities. Examples of this include the company winning a contract extension in June 2018 from NBN, a government entity established to develop and operate Australia’s wholesale broadband access network. In October Service Stream won a strategically important contract with Optus, the second largest telecommunications company in Australia, to help complete its 5G network rollout. Having won this contract, the Group will be providing services on all the three wireless network carriers in the country. For the year ended June 2019, Service Stream delivered strong results with revenue increasing 35% and ebitda 41%, compared to the previous year.

SMS

SMS was established in 2003, initially focusing on job placement services for medical and nursing care professionals in Japan, but more recently has moved into providing information infrastructure related to an aging society, launching over 40 services since then. This includes offering services such as drug and healthcare information services as well as a management support platform for nursing care operators. SMS holds strong positions in markets which are expanding due to an aging population in Japan as well as economic growth in Asia.

In Japan, seniors already constitute 28% of the population, with medical expenses and paid benefits under nursing care continuing to increase. As a result, the growing demand for accurate presentation of highly specialised information regarding medical and nursing care presents a potentially large business opportunity. SMS has offices mainly across Asia Pacific, including Singapore, China, India, Australia and New Zealand. Led by CEO Natsuki Goto, one of the group’s strategies has been to establish itself as the global leader in recruitment of healthcare professionals. Overall, the Group’s aim is to create the information infrastructure to contribute to the well-being of the aging society. The Group reported strong results for the half year to September 2019, with sales up 17% to ¥18bn year on year, and the group guiding for FY2020 revenue up 22% to ¥38bn.

TopBuild

TopBuild, spun off from Masco Corporation in 2015, is a leading installer and distributor of insulation products to the US construction industry. Led by CEO Jerry Volas since IPO, the Group has developed a diversified business model with continued focus on operational efficiency enhancements and has positioned itself to take advantage of market conditions. Encouraged by recent strong results the Group raised its guidance for FY19.

The Group provides countrywide installation services through its Contractor Services business TruTeam, which has 190 branches in 43 states. It also distributes products through its Service Partner business with over 70 distribution centres in 35 states. Strong household formations and positive builder sentiment coupled with low mortgage rates and wage growth are driving an acceleration in certain segments of the housing industry. As a priority, TopBuild is targeting acquisition led growth in core areas of residential and commercial insulation. The company has a strong pipeline of targets and has completed 11 acquisitions since 2016. A recent sizable acquisition was that of United Subcontractors Inc. (USI) in May 2018 for $475 million in cash. This strategically important acquisition strengthened TopBuild’s position in the US insulation installation and distribution market, and significantly increased TopBuild’s service capabilities.

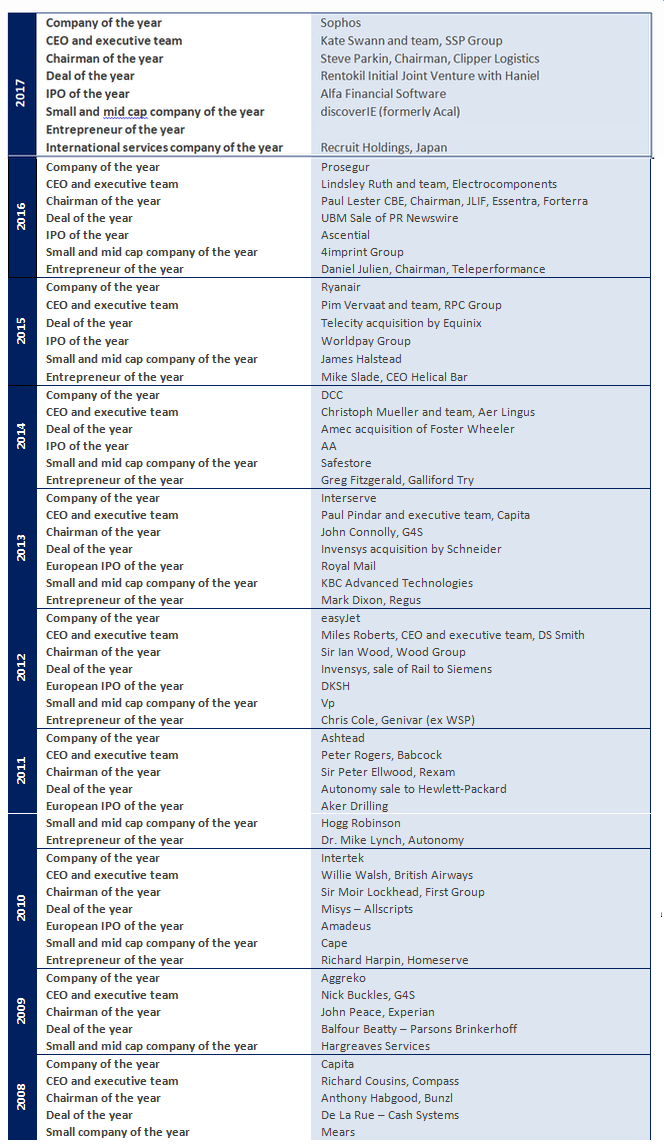

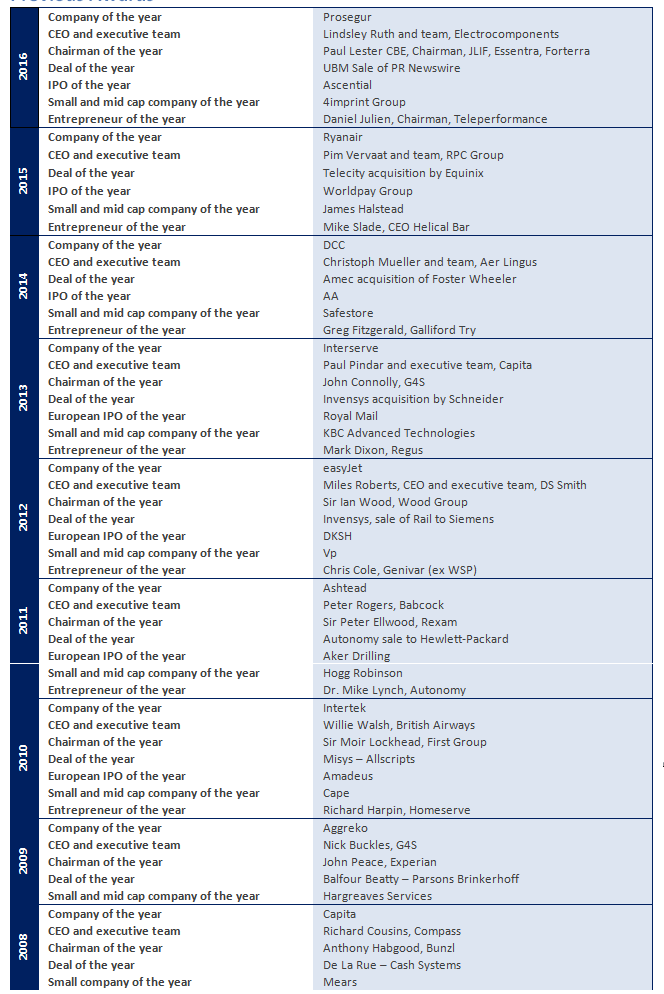

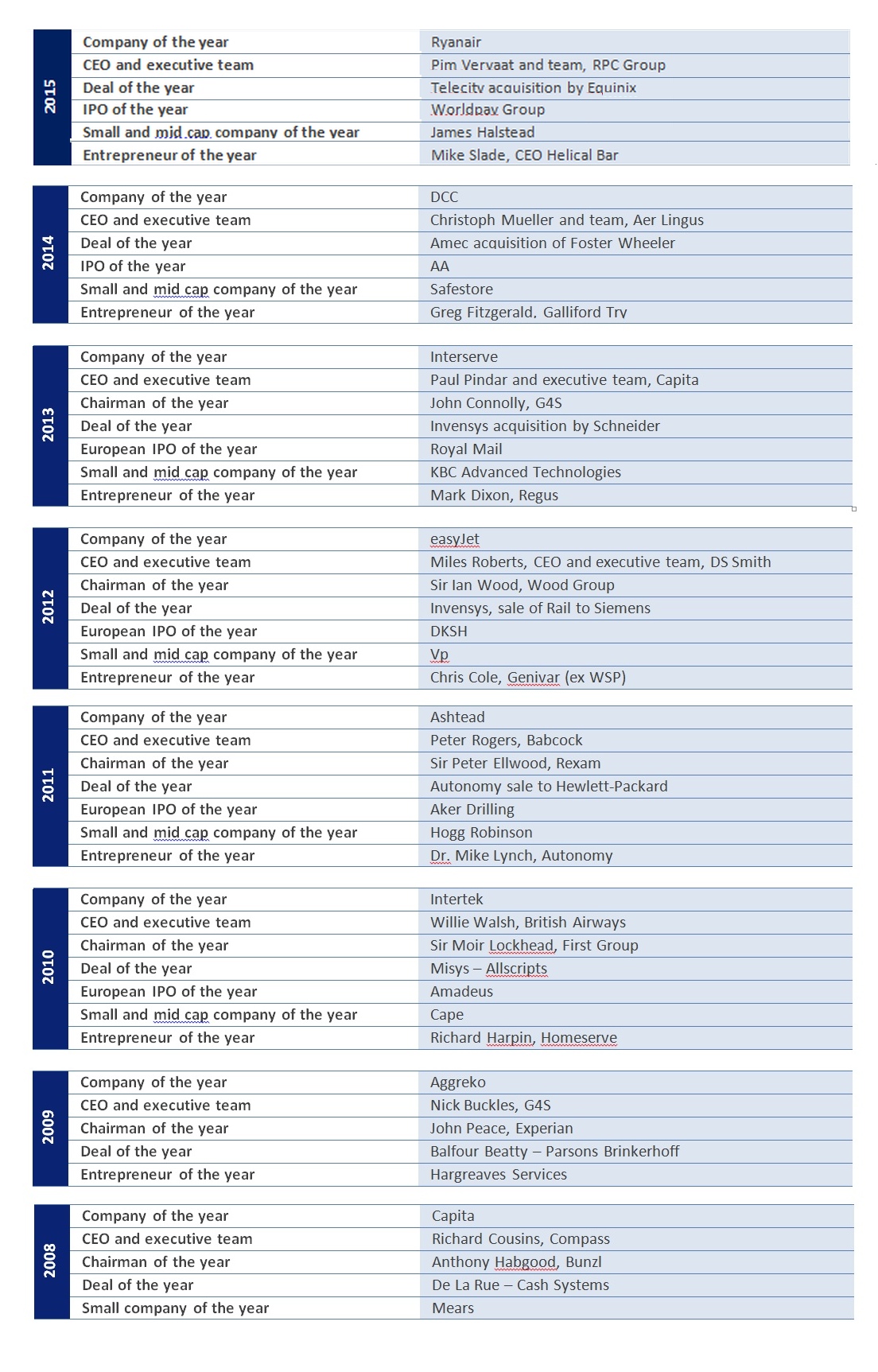

Previous Awards

The finalists of all years can be found on the website www.broadwalkam.com

Disclaimers

Advisory Panel

The firms with whom the individuals on the advisory panel are employed; Barclays, Lazard & Co., Limited, Rothschild and UBS Limited, (an affiliate of UBS AG), may have corporate relationships with companies included in these awards. The inclusion of a company in the awards is not in any way an investment recommendation to buy or sell shares in these companies, or a recommendation to engage in any other business activity or arrangement with them. The inclusion of these companies, and the individuals and transactions, included in these awards represent solely the personal views of the individuals on the advisory panel and does not represent the views of these firms and should not in any way be attributed to them. Where UBS and Barclays has active research coverage of a company for consideration they abstained in providing a view on that company.

Broadwalk Asset Management LLP

This document is issued by Broadwalk Asset Management LLP which is authorised and regulated by the FCA. The Awards do not constitute investment advice. Funds that are controlled by Broadwalk Asset Management LLP and its members may have positions in some of the companies mentioned in the Awards. This document should not be distributed to any third party without the express approval of Broadwalk Asset Management LLP.

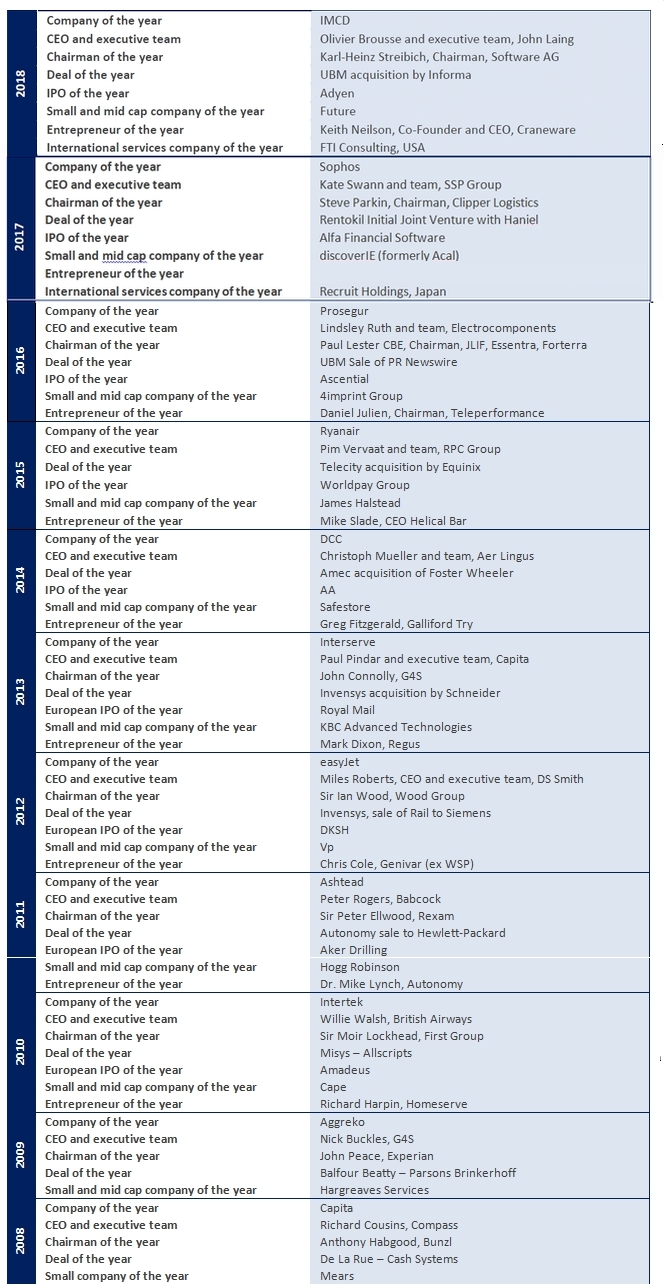

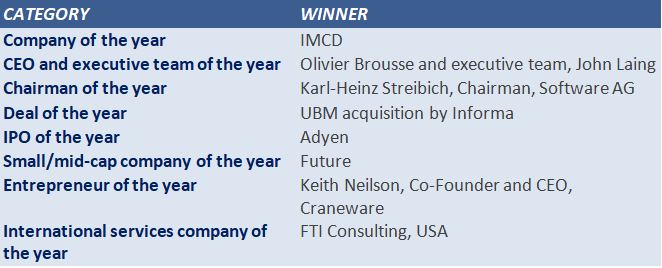

BROADWALK SERVICES AWARDS 2018[+/-]

Eleventh year of recognising outstanding achievements in the services sectors

This is the eleventh year of the Broadwalk Services Awards to recognise outstanding achievements by quoted companies and their management teams in the broadly defined business services sectors. Competition was again fierce with a strong array of contenders – highlighted by the impressive short lists. The broadly defined services sectors are one of the less well known success stories of the global economy and are amongst the largest private sector employers. These unique awards are another step towards raising the companies’ and the sector’s profile. We congratulate all the companies and their management teams.

Charlie Cottam - founder of Broadwalk Asset Management.

ADVISORY PANEL

The awards have had the significant benefit of views from:

- Jarrod Castle, BLT Sector Head, UBS Investment Research

- Vasco Litchfield, Managing Director, Lazard

- Jane Sparrow, Director Mid&Small Cap Support Services Research, Barclays

- Stuart Vincent, Managing Director, Rothschild

BROADWALK ASSET MANAGEMENTBroadwalk Asset Management LLP is a private investment management company based in London. It was founded in 2007 by Charlie Cottam and manages an absolute return strategy which focuses on investing in publicly quoted Services companies. This includes equities in the Support Services, Construction, Real Estate, IT, Transport and Healthcare sectors.

Important disclaimers are at the back of this document.

AWARDS AND SHORT LISTS

Company of the Year [top] - IMCD

Piet van der Slikke has been CEO since the company’s formation in 1995. It has become a world leader in the distribution of speciality chemicals and food ingredients, partly by consolidation. Since its 2014 IPO, the group revenues have grown 55% to €1.9bn in 2017. IMCD now offers best in class solutions including innovative formulations to 37,000 customers and a diverse range of suppliers in 45 countries across 6 continents. The Group targets opportunities to broaden the product portfolio and to expand to new geographies. In 2017 IMCD acquired L.V. Lomas, one of North America’s leading distributors of specialty chemicals which enabled IMCD to further strengthen its position in the US and to create a significant presence in Canada. In June 2018 the company bought E.T. Horn, a leading speciality chemicals distributor in the US which has proved an excellent fit. In September 2018, IMCD made another important acquisition, of Velox in Germany. Velox strengthened its positioning in speciality plastics and additives. IMCD had strong results for the first nine months of this year. With revenues of €1.8bn, the company generated 29% constant currency revenue growth, of which 11% was organic growth.

SHORTLISTED

Edenred

Listed on the Paris Euronext Stock Exchange since 2010 when it was demerged from Accor, the business has been a great success as an independent entity. Bertrand Dumazy has been Chairman and CEO since late 2015. Originally an employee benefits business where it is still global leader it has diversified to become a world leader in transactional solutions for companies, employees and merchants, including Fleet and Mobility (for Toll Roads and Fuel Cards) and Corporate Payments. Employee benefits still account for about 65% of the business. In 2017 Edenred worked with almost 800k clients, was used by about 44m employees who made 2bn transactions worth €26bn through 1.5m partner merchants. The Group has substantial operations in Europe and Latin America and smaller activities in N America and the Far East. Profits look to return to healthy growth after several years of stagnation. In November 2018, Edenred bought US firm Corporate Spending Innovations (CSI), which provides corporate payment solutions, for c$600m. Edenred still has significant firepower for further acquisitions to grow as a business payment solutions provider. The Group has set annual medium term targets including like for like operating revenue growth more than 7%, operating ebit growth more than 9% and growth in cash from operations more than 10%. For the first nine months of 2018, revenue was €990m, up 11% like for like.

Juventus

Juventus is a leading international football club that originated in Turin, Italy in 1897. It is the most successful Italian football club, having won 65 official competitions. Juventus is 4th in Europe and 8th globally to have won the most international titles. Under CEO Giuseppe Marotta from 2010 to very recently the Club won seven consecutive Scudetti, four Italian Cups consecutively, three Italian Supercups, and two Champions League Finals were reached in three years. Apart from the sporting successes, other key developments include inauguration of the new futuristic Allianz Stadium and the formation of Juventus Women. The club is also developing a large project, the J Village, which will host the new Juventus headquarters, its training centre, youth academy, a J-Hotel and a concept store. For the fiscal year ended June 2018, revenues were €505m, a decline of 10% compared to the same period last year. The year saw a loss of €19m compared to profit of €43m the previous year. After the summer World Cup the Club, in what was seen as major coup in the sporting world, signed for €100m, 33 year old Cristiano Ronaldo, the winner of an unprecedented 5 Ballon d’Or awards. Exor N.V. through its subsidiary Giovanni Agnelli B.V. holds 64% stake in Juventus.

Nemetschek

The company develops Building Information Modelling (BIM) software which enables architects, engineers, construction companies and building managers to plan, exchange information and collaborate more closely. Deputy Chairman Professor Georg Nemetschek, who founded the company in 1963, still holds a majority stake of 53%. The company went public in 1999 and now supports c.4m users globally through its 16 brands in 67 locations, selling to 142 countries. Patrik Heider CFOO (Chief Financial and Operations Officer) joined Nemetschek in 2014. Nemetschek generated four year revenue CAGR of more than 20% in a market estimated to be worth €8bn by 2021. Growth is driven by increased penetration of digitisation compared to other industries, a shift to 3D, and an increase in regulations globally. Construction is also growing from urbanisation and population growth, and has been helped by acquiring Bluebeam and Solibri. In August 2018, Nemetschek became an end-to-end solutions provider for the entire building life cycle through the strategic acquisition of Belgian MCS Solutions. MCS Solutions offers Integrated Workplace Management System (IWMS) which services core workplace functions and has a smart building platform that uses IoT (Internet of Things) sensors and big data analytics. With a healthy balance sheet and strong cash generation, Nemetschek is well positioned to generate growth organically and through acquisitions. In the nine months of 2018, revenues grew 14% to €331m, of which recurring revenues making up 49% of total grew at 21%. Earnings (ebitda) grew 15%.

Pearson

CEO John Fallon has been leading the turnaround at Pearson, the largest education and learning company in the world. The company has had to address the structural shifts of lower rates of US college enrolment, and students renting text books rather than buying. Since becoming CEO in 2013, Fallon has streamlined the employee base with a reduction of 10, 000. In 2015, Pearson divested Financial Times and its 50% stake in Economist to focus on education. To strengthen the balance sheet, Pearson sold a 22% stake in Penguin Random House for c. US$1bn in July 2017. Also, in October 2017, Pearson launched a £300m a share buyback programme which ended in April 2018. Fallon has embarked on the “digital first” strategy with digital growth partially offsetting textbook decline. In February 2018 it agreed to integrate Microsoft’s artificial intelligence capabilities into its market leading English language learning curriculum. For the nine months of 2018, total revenues were flat year on year as the expected decline in US Higher Education Courseware was offset by growth in rest of the Group. The company is on track to deliver annualised cost savings of £300m, with full benefits materialising from end of 2019.

CEO and executive team of the year [top]

John Laing Group CEO Olivier Brousse and executive team

John Laing Group CEO Olivier Brousse (left) with Charlie Cottam

Together with his team, Olivier Brousse, CEO of the leading global infrastructure investor John Laing Group since 2014, has significantly developed the company’s previous UK focus, to an international footprint. He initiated a rights issue of £210m in March 2018. Brousse and his executive team’s objective was to take advantage of their strong pipeline, particularly in the US, which grew primarily as a result of the company’s excellent relationships with leading international contractors in a rapidly growing market. These relationships are considerably assisted by Laing’s highly experienced regional managers, who actively manage projects from bidding to construction to delivery. John Laing’s £383m investment commitments, announced in December 2017, were well ahead of its guidance. In May, the Group sold its 15% stake in the Intercity Express Programme (IEP) Phase I to AXA for £228m, in excess of the portfolio valuation at December 2017. This year, with an enhanced capital base, John Laing’s bidding teams have again been very active, with recent investments in the US and Australia. The Group delivered strong first half year results realising £241m from sale of investments, up 60% from the £151m in the comparable period of previous year. NAV per share rose 9% to 307 pence at the end of June 2018 from 281 pence in December 2017. The Group’s potential investment pipeline was an impressive £2.3bn at the end of first half of 2018.

SHORTLISTED

Entertainment One - CEO Darren Throop and the executive team

Since his appointment in 2001, CEO Darren Throop has built a global entertainment Group, Entertainment One (eOne), with annual revenues of US$1.4bn. Based in Toronto, it is now a pure play content licence company. The Company's rights library was worth $2bn in March 2018, and includes the Peppa Pig and PJ Masks brands in the preschool market. eOne entered production in 2015 with the acquisition of 51% stake in Mark Gordon Company for US$133m. This enabled the company to sell content to 500 broadcasters in around 160 countries. In January 2018, eOne paid US$209m to acquire the remaining stake. The company has also acquired a minority stake in Steven Spielberg's Amblin Partners. In 2015 eOne bought a 70% stake in Astley Baker Davies, part funded by a £201m rights issue. In October 2018, eOne announced a multi-year, first look deal with Mottola Media Group (MMG). On-demand services, whether through traditional TV providers or through offerings such as Netflix, Hulu and Amazon Prime, has seen rapid growth in North America, but many countries are very much behind the curve. With personnel in the less mature but high growth markets in Asia and Latin America, eOne is well placed to take advantage of the shifts as and when they occur. Throop’s ambitious goal is to double ebitda from £100m in 2015-2016 to £200m by March 2020. For the first six months ended September 2018 ebitda grew 10% to £60m with margin up 160 basis points to 14.8%. The Group also aims to deliver £13-15m of annualised cost savings by end of fiscal year 2020.

Schibsted - CEO Rolv Erik Ryssdal and the executive team

Schibsted is an international media group with operations in 22 countries. Rolv Erik Ryssdal, CEO joined Schibsted in 1991 and became CEO in 2009. Ryssdal has done an impressive job in shifting from declining traditional media to fast growing digital, and steadily acquiring a portfolio of newer businesses. As well as owning newspapers in Nordics, it is now a world leader in online classified adverts, ranking number one in 18 countries including France, Spain, Sweden and Brazil with a reach to 200m people. Monetisation has been supported by the portfolio of leading brands, focus on product development and well established traffic positions. Examples are the 2018 investment in real estate business habity and the 2017 investments in education tech business poio, fintech startup Harvest which offers robot managed fund, ahum a digital health marketplace, yepstr a first time jobs marketplace for youngsters and hygglo a rental marketplace. In 2017 Schibsted raised NOK 2.5bn ($300m) in new equity to fund acquisitions. In September 2018, the Group decided to spin off and list the international online classified business (MPI). Schibsted will retain majority shareholding of MPI which will be well positioned to take advantage of the consolidation opportunities in the industry. Schibsted will continue to innovate and build on its market positions in the Nordics. The plan is for 15 to 20% revenue growth in online classified for the next three to five years. Focus will also be on cash flow and profitability. For the first nine months of 2018, operating revenues generated by the Group increased 6.6% to NOK 13.3bn, and ebitda rose 24% to NOK 2.4bn, with adjusted earnings per share up 65%.

Wirecard - CEO Markus Braun and the executive team

Dr. Markus Braun, CEO and CTO of the German fintech company Wirecard, was appointed in 2002 to turnaround the three year old startup. It is now one of the fastest growing digital platforms globally. Wirecard has a German banking licence and holds issuing and acquiring licences from all major payment and card networks. The company offers omni-channel payment solutions to merchants, risk management and physical and virtual payment cards, serving 40,000 large and medium customers and 225,000 small customers. The tailor made solutions have enabled Wirecard to increase its commission on payment transactions to 1.6%. It has expanded in North America and Asia through the acquisition of two portfolios from Citi. Since 2015, Wirecard has offered the fully digitalised, mobile payment-app boon, based on virtual MasterCard which runs on Android and iOS. Boon enables contactless payments and peer-to-peer transactions. Wirecard has been collaborating with AliPay since 2015 and with Tencent since 2017 to offer WeChat Pay. The company expects growth to accelerate over the next decade, and forecasts core profits to grow six fold by 2025 aided by boom in ecommerce and digital payments. Growth is assisted by major deals with banks such as Credit Agricole. Even though the global payment market is highly fragmented, Wirecard will focus on organic growth. In 2020, Wirecard expects to be able to handle more than €215bn in payments and to generate €3bn in revenues compared to €1.5bn in 2017. For the first nine months of 2018, transaction volumes increased 44% to 90bn, with European volumes increasing 21% and non-European volumes rising 78%. Revenues for the nine months of 2018 grew 41% to €1.4bn, ebitda grew 38% to 395m. Following strong performance, the company has raised ebitda guidance from €530-560m to €550-570m. In September it entered the DAX index, and had a market capitalisation of c. €16bn at the end of November.

Chairman of the year [top]

Karl-Heinz Streibich, Chairman, Software AG

Software AG Chairman and CEO Karl-Heinz Streibich

Having spent 15 years at the helm, Karl-Heinz Streibich, Chairman and CEO stepped down in July 2018 having reached the recommended age limit. Under Mr Steinbach’s leadership, Software AG underwent a very significant transformation. He initiated a strategic realignment to focus on the integration business. He established a new second division at Software AG, leading to the company’s global digitisation business. He has built a large portfolio of digital transformation solutions. Mr Streibich also enabled the company to lay the foundations to succeed in Internet of Things, Big Data Analytics and Artificial Intelligence. The Group made 18 acquisitions between 2007 and 2016 to develop its product portfolio. Additionally in March 2017, the Group acquired Cumulocity, a further step in expanding leadership in Internet of Things(IoT). In recent months, Software AG has also announced major strategic alliances with companies such as Bosch, Octo, Dell and Huawei. In June 2018, The Group acquired Belgian company TrendMiner to expand Cumulocity IoT portfolio with an intuitive analytics platform for visualization of time series data. In March to May 2017, the Group undertook a €100m share buyback programme. In January 2018, Mr Streibich appointed as his successor Sanjay Brahmawar who was General Manager, Global Revenue, at IBM Watson in Germany. Mr Streibich has more than 35 years of experience in the international IT services industry with companies such as Daimler-Benz, Dow Chemical, ITT and debis Systemhaus.

SHORTLISTED

Ashtead - Chairman Christopher Cole

Chris Cole (Broadwalk Entrepreneur of the Year 2012) was appointed Non-Executive Chairman in March 2007. Mr Cole retired in September 2018, when the share price was 2,437p, up from c.150p on his appointment. He was member of the Board which appointed Geoff Drabble as CEO in 2007. Mr Cole steered the company through a very difficult time during the 2008-2009 financial crisis and set the company on its trajectory of organic growth combined with acquisitions. During the many years under Mr Cole’s leadership and counsel, Ashtead has made considerable progress to grow into one of the biggest and most successful equipment rental companies globally. Mr Cole’s significant contributions include successful negotiations with banks and instigation of some important acquisitions including that of Pride Equipment Corporation and CRS Contractors Rental Supply. Mr Cole, who has over 40 years of experience in engineering and consulting services, was previously Non-Executive Director at Ashtead since 2002. He is the founder of WSP Global. Additionally, he is Non-executive Chairman of Tracsis, Redcentric and Applus+.

McCarthy & Stone - Chairman Paul Lester CBE